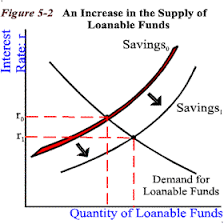

- Remember that supply of borrowing of loan-able funds = savings (liw demand for bonds)

- more savings= more supply of loan-able funds (->)

- less savings = less supply of loan-able funds (->)

- EX -

- -- Government budget surplus = more savings= more supply Loan-able funds .: Slf -> .: v

- -- decrease in consumers MPS = less saving = less supply of loan-able funds .: slf <- .:r ^

Final Thoughts on Loan-able Funds

- loanable funds market determines the real interst rate

- when government does fiscal policy it will affect the loan-able funds market

- changes in the real interst rate (r%) will affect Gross Private investment.

Federal Fund Rate- the interest rate that commercial bank, change other commercial banks for over night

- discount rate- loans form FED

- Sister banks- federal fund rate

Prime Rate- the interest rate that is given to a banks most credit worthy consumers

o-4%

No comments:

Post a Comment