- Changes in the expenditures or tax revenues of fiscal gov't

- - 2 Tools of fiscal policy

- Taxes - government can increase or decrease taxes

- Spending- government can increases or decreases spending

- Fiscal- is enacted to promote our nation's economic good: full employment, price stability, economic growth

Deficits, Surplus and Debt

- Balance budget

- - revenues =Expenditures

- Budget deficit

- - Revenue < expenditures

- Budget Surplus

- - revenues > expenditures

Government debt

- sums of all deficits - sums of all surpluses

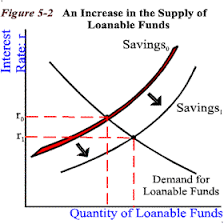

Government must borrow money when it runs a budget deficit

Government borrows from

- individuals

- corporations

-financial institutions

-foreign entities or foreign government

Fiscal Policy Two options

- Discretionary Fiscal Policy-think deficit

- Contractionary Fiscal Policy-think surplus

- Non-Discretionary Fiscal Policy (action)

Discretionary v automatic fiscal policies

-increasing or decreasing government spending and/or taxes in order to return the economy to full employment

-discretionary policy involves policy makers doing fiscal policy in response to an economic problem

-unemployment + compensation & marginal tax rates are examples of automatic policies that help mitigate the effect of recession and inflation. Automatic fiscal policy takes places with out policy makers having to respond to current economic problems

Contractionary VS Expansionary

Fiscal Policy

- contractionary fiscal policy- policy designed to decreased aggregate demand

- - strategy for controlling inflation

Expansionary fiscal policy - policy designed to increase aggregate demand

- strategy for increasing GDP, combatting a recessionary &reducing unemployment

Expansionary Fiscal policy

-increase government spending (G ^)

- decrease taxes (Tv)

* notice that the PL increase

Contractionary Fiscal Policy

- decrease government spending

- Increase

Automatic or Built- In stabilizers.

* anything that increases the government increases its budget deficit during a recession and increases its budget surplus

Without requirement explicit action by policy makers

Economic Importance

- taxes reduces spending and AD

- reductions in spending are desirable when the economy is moving toward inflation

- increases in spending are desirable toward recession

Transfer payment

a. welfare check

b. food stamping

c. unemployment checks

d. corporate dividends

e. social security

f. veteran benefits

Progressive Tax system

* Average tax rate ( tax revenue/ GDP)

Proportionary Tax System

* Average Tax rate remains constant as GDP changes

Regressive Tax System

* Average tax rate falls